Understanding Home Insurance

Points to note when buying insurance

Benefit limit and mode of claim settlement

Policyholders should fully understand the maximum benefit amount for home contents, as most home insurance policies adjust the amount annually. They also need to pay attention to the benefit limit for each covered item. Insurers classify the covered items into categories, such as valuables, wine, frozen food and outdoor property, and then determine the benefit limit for each category.

Also, instead of a cash settlement, insurers may offer other settlement methods, depending on the situations, such as providing repairs, reinstatement or replacement of the damaged item(s).

Deductible

Some home insurance policies have a deductible for different categories of insured items. The deductible refers to the amount of each claim payable by the policyholder. The amount in excess of the deductible is compensated by the insurer, according to the policy terms. For example, if the compensation for a claim is $12,000 and the deductible is $3,000, the policyholder has to pay $3,000, and the insurer covers the remaining $9,000.

Provide the insurer with up-to-date information in a timely manner

Policyholders should notify their insurer when they move home or make a structural change to the building during the policy period. Any changes, such as interior decoration of an insured property, may increase the possibility of loss or damage. The policy may be underwritten by the insurer again, and the policyholder may be required to pay an additional premium to reflect an increase in risk. Failure to notify the insurer of such a change may result in a claim being declined.

Open kitchens are a very common structural change nowadays. Policyholders should ensure such renovations are not in violation of any statutory regulations and meet the fire safety requirements, so as not to affect the validity of the home insurance policy.

Policy renewal

The policy period of home insurance is one year in general and is renewable every year. In normal practice, insurers notify policyholders or issue a renewal notice before the policy expires. Before renewal, policyholders should consider whether the policy still suits their personal needs and pay attention to any changes in the premium and terms because insurers may evaluate the insured property again and adjust the premium if a claim was filed in the past.

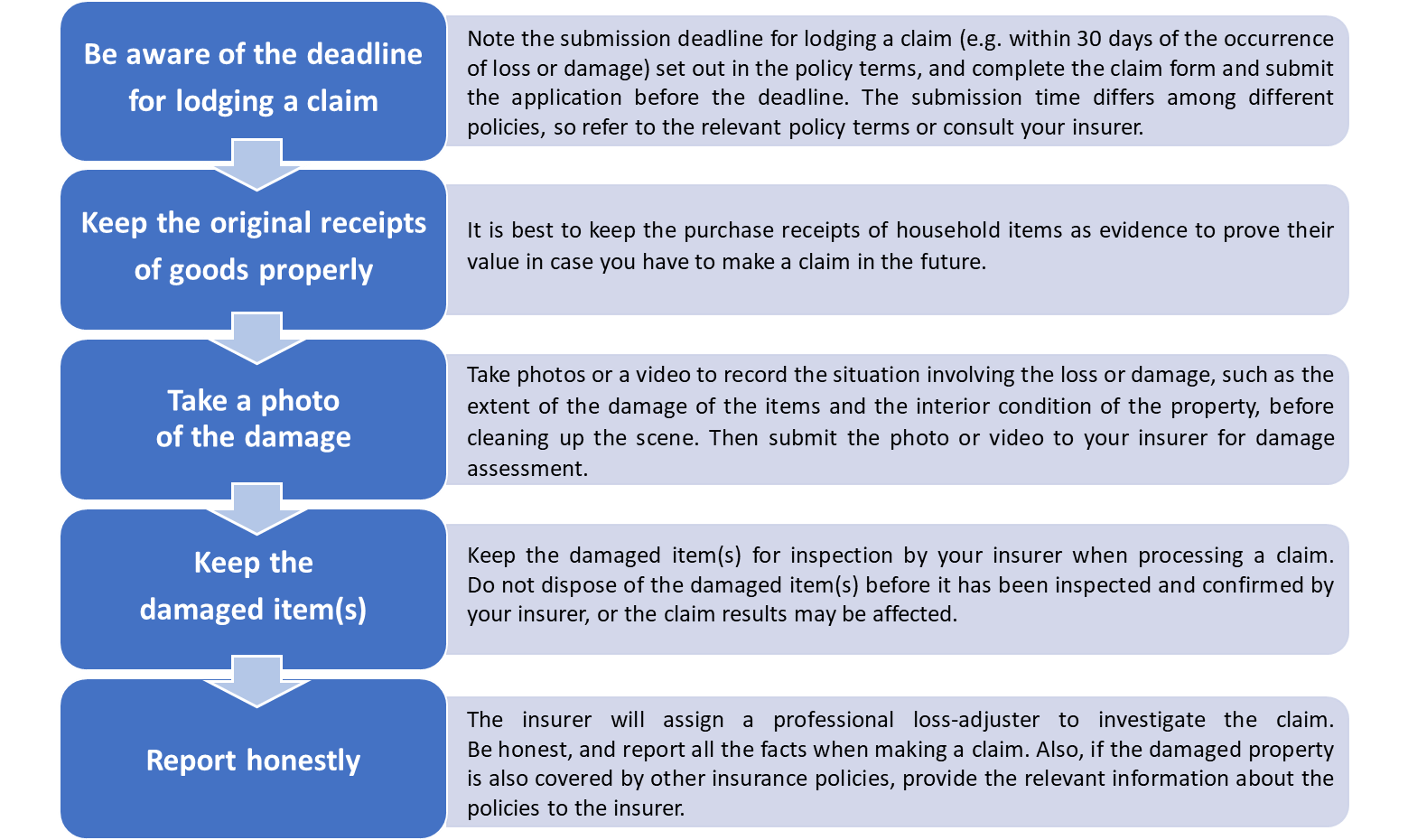

Points to note when making a claim

When making a home insurance claim, policyholders should note the following:

- Things to be aware of when handling third-party claims: For a claim involving third-party liability, do not enter into any settlement agreement or compromise regarding the loss or admit liability to a third party to avoid any violation of the claim procedure, which may affect the claim results. Insurers may refuse to handle a case or even deny the claim if liability is admitted. The policyholder should notify the insurer immediately and refer the claim request to the insurer and other professional parties for handling. The insurer may appoint an individual loss-adjusting firm to clarify the liability for compensation in response to the claim.

- Make a police report: In the event of loss due to theft or malicious damage, make a police report immediately (within 24 hours in general), and retain a copy of the police report with the reference number. If the situation allows, take photos or a video of the scene of the incident as evidence and notify the insurer about the claim as soon as possible.

The above information is for reference only. For the coverage, benefit limits and premium levels of a specific home insurance plan, please refer to the relevant policy terms.